Sourcescrub and Grata are joining forces to deliver the market’s most complete market intelligence platform

Learn more

2021 witnessed record-breaking private equity platform investments. How can firms ensure even greater success in the future? By prioritizing add-on acquisitions!

Add-ons provide tangible avenues to enhance and optimize the value of deals secured in 2021. Additionally, delving into potential add-ons can reveal hidden proprietary investment opportunities within lesser-known bootstrapped companies.

In this guide, we aim to assist firms in comprehending the terms, advantages, and tactics essential for mastering add-ons this year and beyond. Let's dive deeper!

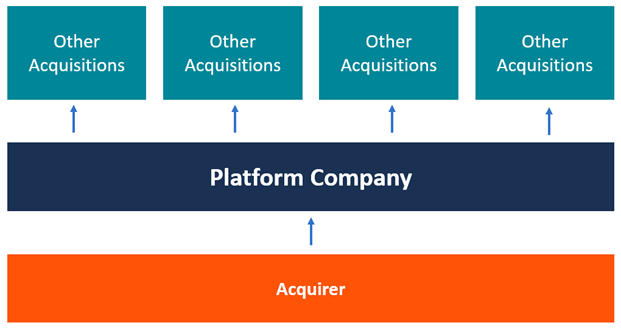

An add-on acquisition is when a private equity firm or other buyer acquires a company and integrates it into an existing business within the buyer's portfolio, which is referred to as a platform company. Add-ons are generally smaller, strategically positioned, and sought out to add value to and stimulate growth within larger, more established platform companies. This is often called a "buy and build" strategy. Add-ons can also be a way of bumping up platform company value before a sale.

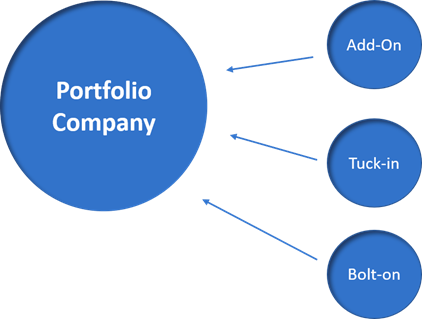

There are generally 3 types of add-on acquisitions: bolt-on acquisitions, tuck-in acquisitions, and roll-up acquisitions.

Sometimes referred to generally as "add-ons," bolt-ons offer complementary yet enhanced technology or market opportunities for larger platform companies. They typically retain their identity after the investment and are acquired for strategic cross-selling purposes that benefit both companies.

A tuck-in acquisition is a company with very niche but complementary and critical product functionality. Tuck-ins are absorbed into larger platform companies to quickly improve their offerings and revenues, as well as to avoid having to build specific functionality from scratch.

Roll-up acquisitions are horizontal acquisitions that are "rolled up" into a larger platform company. In these cases, the platform company has usually developed a cookie cutter model for success that is implemented across each roll-up for rapid scalability.

Because they're smaller acquisitions meant to multiply the value of already healthy businesses, add-ons are much less expensive, present lower risk, and attract far less LP scrutiny compared to platform investments. They even close in as few as 45 days. Additionally, many add-ons in private equity are used to stimulate the development of a company that the firm has interest in growing and increasing the value of, with the goal of taking it public or selling it for a greater return on their investment.

PE firms usually pursue add-on acquisitions because of the following benefits:

A good add-on strategy usually starts in the thesis development stage. It involves identifying key market segments that can be profitably pursued by a potential platform company prior to making an investment. Some firms also explore add-on opportunities in the due diligence phase.

Unfortunately, since add-on companies are often smaller, lesser-known bootstrapped companies, finding information about them is extremely difficult and time-consuming for firms. This is why new school dealmakers are turning to private company intelligence platforms to help them do this work. These tools combine robust filtering and search functionality to surface and analyze all the available data on non-transacted companies in a given space. Firms can then use this information to quickly get up to speed on particular markets and map them out.

Market mapping is a process that involves creating and analyzing a graph based on current competitive data to identify the various factors that affect a given market. During this exercise, associates identify the various players within a given space and map out their roles in the larger ecosystem. They then segment companies into smaller categories such as sub-industries to better understand a platform investment's strategic position and corresponding add-on and exit opportunities.

Manual data search for market mapping is extremely time-consuming and often leads to error-filled results, which is why using the right tools is mission-critical. When researching which tool to use, make sure you choose a platform that offers the quantity and quality of data you need for accurate reporting and decision making.

Besides company size and revenue, data signals like company job listings and executive hires indicate positive growth especially when it comes to bootstrapped companies. Create a "watchlist" of potentially lucrative add-on opportunities and work with your private company intelligence platform to set up custom alerts for up-to-the-hour news and freshly published data on these companies.

Modern dealmakers are also developing lead-scoring models to identify and rank possible add-on targets based on these various data signals. This approach helps firms pinpoint the most compelling opportunities and rapidly prioritize those with the highest potential to close based on thesis fit and platform company alignment.

A leading private equity group sought to better identify opportunities that aligned with its portfolio companies' add-on strategies. To generate exclusive market intelligence, the firm integrated Sourcescrub's full private company dataset with information from key internal sources in its data warehouse. The team now runs complex analyses and develops custom models to surface previously hidden opportunities that match portfolio companies' unique corporate development criteria. Turning data into a proprietary advantage has driven a 3x increase in deal volume!

Add-on-worthy companies often attend industry conferences to scope out the competition and potential investors. Rather than frantically searching exhibit halls for the right companies, scrub attendee lists to figure out who is attending and identify any potential opportunities ahead of time. Brushing up on these companies before you hit the virtual or hybrid "conference floor" helps firms build better relationships faster and earlier with up-and-coming players.

Sourcescrub plays a vital role in optimizing the value of opportunities through data, intelligence, and continuously updated industry information. Beyond fueling add-on strategies, our private company intelligence platform empowers firms to uncover a multitude of new platform investment opportunities.

The steps outlined in this post serve as an excellent starting point for identifying the right add-ons for your firm. However, we have plenty more strategic insights to offer for successful add-on investment in private equity! Download our extended guide to add-ons to explore further.

Originally posted on "February 1, 2022"