ChatGPT burst onto the scene last December and immediately took the world by storm, reaching 100 million users in just two months. Yet despite its popularity, many still question how to properly use this new generative AI technology to make a real impact.

To help dealmakers, Sourcescrub partnered with ACG and sat down with John Shaw, generative AI entrepreneur and CEO of Add Value Machine, to discuss the evolution of AI, practical uses of the tech, and pitfalls to avoid.

While OpenAI's ChatGPT may have been the first interaction with AI for many, humans have been fascinated with the technology for decades. In fact, traditional AI has been traced all the way back to the 1950s, though it was understandably limited by the computing power available at the time.

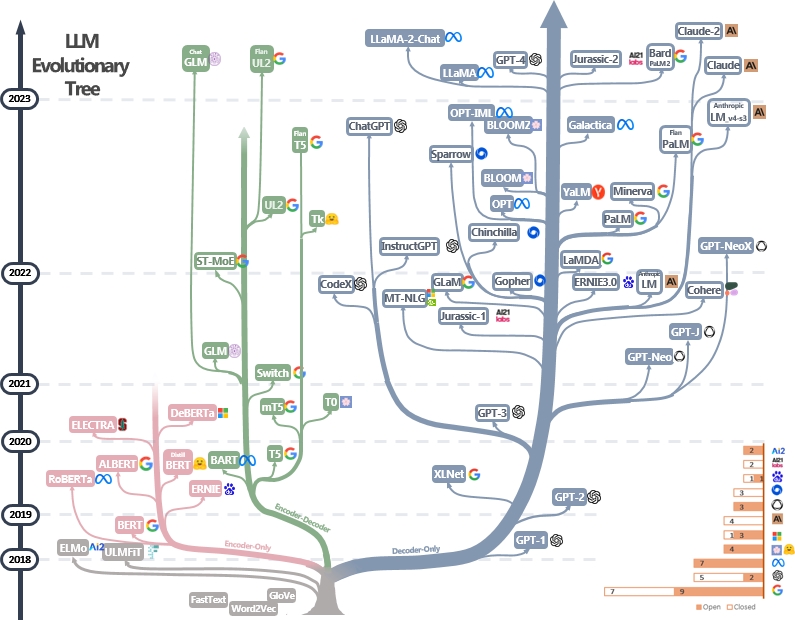

A breakthrough occurred in the 80s with the development of neural networks, and again 30 years later with deep learning algorithms in the 2010s. Today, however, the generative AI with which we are so familiar is based on large language models (LLMs), which use incredible amounts of data to learn patterns and generate coherent and realistic text.

You can think of it like the scene when Ultron first wakes up in the Avengers movie. Though Ultron came equipped with the ability to understand speech, it finds and consumes thousands of videos and documentation in mere seconds to help it better understand the world around it.

ChatGPT and other LLMs, while decidedly less evil, are based on the same principle: use trillions of available data points to learn, recognize patterns, and then generate conclusions. There are also countless generative AI models available for various purposes. For instance, ChatGPT is largely text-based, while others, such as DALL-E, produce visual results. Each model is also designed for different goals, like customer service or code generation.

Since ChatGPT didn't come onto the scene until December 2022, once budgets for 2023 were already locked, many organizations simply didn't plan for generative AI and are currently racing to catch up. Some 2 in 3 IT leaders are making generative AI a priority within the next 18 months, and 86% believe it will play a prominent role in their organizations.

Many software companies have already begun integrating AI into their existing platforms for work such as generating emails and summarizing meeting notes. In our webinar, Shaw showed off AWS QuickSight, an analytics platform that lets you use AI to generate charts from a prompt (e.g., "Show me recent monthly sales categorized by type in descending order in a stacked bar chart").

But for private equity, there are more ways to use AI. Take, for example, how LFM Capital uses Sourcing GPT. "The way that this tool can help us build a landscape of 'like' companies, those with similar characteristics to ones we've identified as having outstanding potential, or that are already in our portfolio with more accuracy and speed is remarkable," said Jessica Ginsberg, LFM's Managing Director.

GenAI may also drive new sources of value. With AI, the data within a company could now be the reason to make a deal. Consider all the data in failed clinical trials. For those firms that participate in the pharmaceutical industry, with the right models, AI-assisted research could help create new drugs based on what might've once been considered dead data.

Shaw also discussed how AI can help with a consistent goal in PE: maximizing EBITDA. In every deal, you should now ask, "What could an AI model do for me to reduce resource consumption?" Following Shaw's example of AWS QuickSight, could a company's data analysts focus on more impactful tasks than simply generating reports? Or, perhaps with a code-generating AI model, engineering costs could be reduced or reallocated.

As with any technology, however, AI is not without its challenges. Shaw detailed several issues facing the use of AI in private equity:

With the right precautions, however, AI can still provide great benefits. Some AI-powered dealmaking tools pair it with humans to ensure integrity and quality, a practice referred to as "expert-in-the-loop machine learning." Since AI can only make conclusions based on the data it's been given and cannot tell if a result is "good" or "bad," you should always aim to temper AI with human intuition and reasoning.

For many firms, using AI will start gradually. While nearly 80% of our webinar attendees had dabbled in ChatGPT, Shaw offered several tactics to help dealmakers become more proficient:

As we discussed, ChatGPT isn't the only way for your firm to benefit from AI. From creating emails and analyzing data to helping you more easily find target opportunities and source deals, AI is poised to revolutionize how PE does business. To hear the rest of the tips Shaw offered and learn specific ways to use AI and streamline your deal sourcing process, watch the on-demand webinar here.